Blog by CryptoAPE | Digital Diary

" To Present local Business identity in front of global market"

" To Present local Business identity in front of global market"

Digital Diary Submit Post

Digital Diary Submit Post

Cryptocurrency trading has matured rapidly, and by 2026, traders are far more selective about where they trade. Bitstamp, one of the oldest crypto exchanges, often comes up in conversations about reliability and trust. But is it still a good choice today-or are traders and businesses looking beyond it, including solutions like a Bitstamp Clone Script?

This guide breaks down Bitstamp's relevance in 2026, its strengths and limitations, and what modern traders and entrepreneurs should realistically consider.

Bitstamp has been operating since 2011, surviving multiple crypto cycles, regulatory shifts, and market crashes. That alone gives it credibility.

Key strengths that still matter in 2026:

Strong regulatory compliance in Europe and global markets

Transparent fee structure compared to many newer exchanges

Deep liquidity for major trading pairs like BTC, ETH, and XRP

Proven security history with cold storage and audits

For conservative or institutional-minded traders, these factors still carry weight.

While Bitstamp remains stable, user expectations have evolved.

Limited altcoin listings compared to modern exchanges

Fewer advanced trading tools and automation features

UI feels basic for experienced, high-frequency traders

Slower innovation in DeFi, Web3, and AI-driven trading tools

This gap is why many startups now explore launching platforms using a Bitstamp Clone Script-to keep Bitstamp's reliability while upgrading features.

A Bitstamp Clone Script allows businesses to replicate Bitstamp's core exchange model while customizing it for today's market.

Popular reasons exchanges choose a Bitstamp Clone Script:

Faster launch compared to building from scratch

Built-in spot trading, order books, and liquidity logic

Custom fee models, KYC workflows, and UI upgrades

Easier integration with modern APIs, wallets, and compliance tools

In short, it's a way to modernize a proven exchange framework without reinventing the wheel.

Prefer safety and regulation over aggressive features

Trade major cryptocurrencies, not niche tokens

Value long-term stability over experimentation

Trade altcoins, derivatives, or use bots

Want advanced charting and AI-driven insights

Expect faster product innovation

Interestingly, while some traders move beyond Bitstamp, many exchange founders still look to it as a benchmark. That's where the Bitstamp Clone Script fits-offering reliability with room for innovation.

Bitstamp is still a solid, trustworthy exchange in 2026-but it's no longer the most feature-rich option. For traders, it's best suited for safe, regulated spot trading. For entrepreneurs, the smarter move is often launching a modern exchange using a Bitstamp Clone Script that matches today's user expectations.

Is Bitstamp safe to use in 2026?

Yes. Bitstamp maintains strong security practices, regulatory compliance, and a long-standing reputation for safety.

Does Bitstamp support advanced trading features?

It supports basic and intermediate trading, but lacks many advanced tools offered by newer platforms.

What is a Bitstamp Clone Script?

A Bitstamp Clone Script is a ready-made crypto exchange software modeled after Bitstamp, customizable with modern features.

Is a Bitstamp Clone Script suitable for startups?

Yes. It's ideal for startups seeking faster deployment, proven exchange logic, and regulatory-ready architecture.

Should traders move away from Bitstamp?

Not necessarily. It depends on your trading style, asset preferences, and need for advanced tools.

If you're exploring modern crypto exchange solutions, start by learning how a Bitstamp Clone Script can help you launch faster, scale securely, and stay competitive in 2026 and beyond.

You have not enough Humanizer words left. Upgrade your Surfer plan.

Read Full Blog... Peer-to-peer crypto trading has grown steadily as users look for more control over how they buy, sell, and move digital assets. Instead of relying entirely on centralized exchanges, many traders prefer platforms that let them interact directly with each other using escrow-based protection. For entrepreneurs and product teams planning to build a P2P crypto platform, two common reference models ofte...

Read More

Peer-to-peer crypto trading has grown steadily as users look for more control over how they buy, sell, and move digital assets. Instead of relying entirely on centralized exchanges, many traders prefer platforms that let them interact directly with each other using escrow-based protection. For entrepreneurs and product teams planning to build a P2P crypto platform, two common reference models ofte...

Read More

Peer-to-peer crypto trading has grown steadily as users look for more control over how they buy, sell, and move digital assets. Instead of relying entirely on centralized exchanges, many traders prefer platforms that let them interact directly with each other using escrow-based protection.

For entrepreneurs and product teams planning to build a P2P crypto platform, two common reference models often come up: Coinbase-style exchanges and Paxful-style marketplaces. While both support crypto trading, they differ significantly in structure, user behavior, and long-term platform strategy.

This article takes a practical, side-by-side look at Coinbase Clone Script vs Paxful Clone Script, focusing on how each model functions in real-world P2P environments-and which may be more suitable depending on your goals.

A P2P crypto trading platform connects buyers and sellers directly rather than acting as a central trading counterparty. The platform's role is to provide:

Trade matching tools

Escrow protection

Dispute resolution

Wallet infrastructure

Trust and reputation systems

This structure is especially relevant in regions where access to traditional exchanges or banking services is limited.

Both Coinbase-inspired and Paxful-inspired platforms support crypto trading, but they approach P2P functionality very differently.

A Coinbase Clone Script is based on the operational structure of Coinbase, which is primarily a centralized exchange with strong regulatory alignment. P2P trading, when included, is usually an extension rather than the core feature.

Centralized trade execution

Platform-managed pricing and liquidity

Integrated crypto wallets

Strong identity verification processes

Simplified user journeys

Most Coinbase Clone Software solutions are designed to support:

Spot trading

Fiat-to-crypto transactions

Secure asset custody

Mobile-friendly access through a Coinbase Clone App

This model is often preferred by users who value structure, clarity, and guided trading experiences.

A Paxful Clone Script mirrors the marketplace-driven approach of Paxful, where P2P trading is the foundation rather than an add-on.

User-posted buy and sell offers

Direct negotiation between traders

Escrow-based protection

Wide variety of payment methods

Community reputation systems

A standard Paxful Clone Software setup usually includes:

Trade listing management

Escrow wallets

In-platform messaging

Dispute resolution workflows

A mobile-optimized Paxful Clone App

This structure is commonly used in markets where flexibility and payment diversity are critical.

Centralized order matching

Automated pricing logic

Platform-controlled liquidity

Higher operational oversight

This structure supports consistency and scalability but often requires stronger compliance frameworks.

User-driven trade creation

Negotiated pricing

No central liquidity pool

Escrow-focused security

This approach prioritizes flexibility and regional adaptability.

Users typically encounter:

Clean dashboards

Simple onboarding

Straightforward buy/sell flows

Minimal negotiation

This experience works well for users who are newer to crypto or prefer a structured environment.

Users interact with:

Seller profiles and ratings

Trade terms and payment instructions

Real-time chat

Escrow status updates

While it requires more user involvement, it offers greater control over trade conditions.

Payment support is one of the biggest functional differences.

Bank transfers

Cards

Limited regional payment methods

Dependency on licensed payment gateways

Local bank transfers

Digital wallets

UPI and mobile payments

Gift cards and region-specific options

If your platform targets diverse or emerging markets, this distinction becomes especially important.

Centralized wallet security

Cold storage and encryption

Mandatory KYC and AML processes

Automated monitoring

This model focuses on platform-level security and regulatory alignment.

Escrow-based transaction locking

Time-bound trade execution

Manual and automated dispute handling

User reputation systems

Here, trust is built through transparency and community feedback.

Structured identity verification

Transaction monitoring

Jurisdiction-based restrictions

This model fits regions with clear regulatory expectations.

Flexible verification levels

Optional KYC tiers

Adaptable to local regulations

This allows broader access but requires careful policy design.

Trading fees

Fiat processing fees

API access

Premium account features

This structure favors higher-volume trading activity.

Escrow service fees

Trade commissions

Vendor promotions

Featured listings

This model benefits from frequent P2P interactions.

A Coinbase Clone Platform often scales by:

Expanding asset listings

Integrating institutional features

Adding DeFi or Web3 components

A Paxful Clone Platform typically grows through:

Regional adoption

Community engagement

Payment method expansion

Both can scale effectively, but in different directions.

A Coinbase Clone Script may be suitable if:

You want a structured exchange with optional P2P features

Your audience prefers simplicity

Compliance is a priority

A Paxful Clone Script may be suitable if:

P2P trading is your core focus

Users need payment flexibility

You're targeting diverse geographic markets

Some platforms also explore hybrid models, combining centralized trading with P2P escrow systems.

There is no universal answer to whether a Coinbase Clone Script or a Paxful Clone Script is "better." Each serves a different type of P2P crypto trading environment.

Coinbase-style platforms emphasize structure, compliance, and ease of use, while Paxful-style platforms prioritize flexibility, community interaction, and payment diversity. The right choice depends on your audience, regional focus, and long-term platform strategy.

Understanding these differences early helps ensure that the technology you choose supports-not limits-the way your P2P crypto platform is meant to operate.

Read Full Blog... When building a blockchain product on Ethereum, one of the earliest and most important decisions is choosing between fungible tokens and non-fungible tokens (NFTs). This choice influences everything-from how users interact with your platform to how value is created, exchanged, and sustained over time. Many founders explore this question while consulting an Ethereum Token Development Company, simpl...

Read More

When building a blockchain product on Ethereum, one of the earliest and most important decisions is choosing between fungible tokens and non-fungible tokens (NFTs). This choice influences everything-from how users interact with your platform to how value is created, exchanged, and sustained over time. Many founders explore this question while consulting an Ethereum Token Development Company, simpl...

Read More

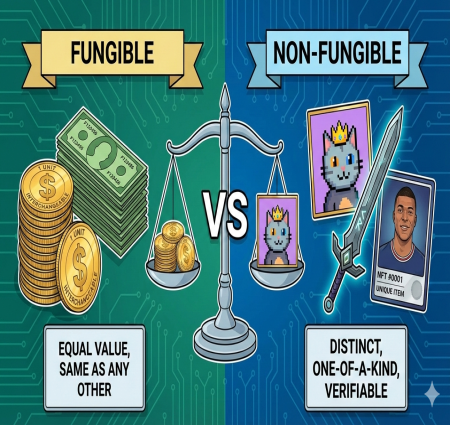

When building a blockchain product on Ethereum, one of the earliest and most important decisions is choosing between fungible tokens and non-fungible tokens (NFTs).

This choice influences everything-from how users interact with your platform to how value is created, exchanged, and sustained over time. Many founders explore this question while consulting an Ethereum Token Development Company, simply because the implications go beyond writing smart contract code.

This guide explains the differences clearly and practically, without hype or promotional language, so you can decide what fits your idea best.

Ethereum allows developers to create tokens using standardized frameworks called token standards. Among them, fungible and non-fungible tokens serve very different purposes.

Fungible tokens are interchangeable. Each unit holds the same value and functionality as another unit of the same token.

If you send or receive one fungible token, it's identical to any other unit in circulation.

They are commonly used for:

Cryptocurrencies and digital money

Governance and voting systems

Utility tokens within applications

Stablecoins and reward points

Most fungible tokens follow the ERC-20 standard, which is widely supported across wallets, exchanges, and decentralized applications.

Non-fungible tokens represent unique items. Each NFT has distinct metadata and cannot be replaced by another token on a one-to-one basis.

NFTs are typically built using ERC-721 or ERC-1155 standards and focus more on ownership than exchange.

They are commonly used for:

Digital art and collectibles

Gaming assets such as skins or characters

Event tickets and memberships

Certificates, licenses, and credentials

Instead of thinking in technical terms alone, it helps to compare them based on how they behave in real-world applications.

Fungible tokens:

Are interchangeable and equal in value

Primarily designed for value transfer and liquidity

Scale efficiently for high transaction volumes

Generally have lower gas costs per transfer

Work well for payments, DeFi, and governance

Non-fungible tokens:

Are unique and non-interchangeable

Focus on ownership, identity, or access

Scale moderately due to metadata complexity

Often involve higher minting and transfer costs

Are best suited for assets, proof, and exclusivity

Understanding these distinctions early can prevent mismatched token models later in development.

Fungible tokens are a strong fit when your platform relies on frequent transactions, shared value, or liquidity.

They are commonly used in:

Decentralized finance platforms

Token-based reward or loyalty systems

DAO governance and voting mechanisms

In-app or in-game currencies

Because ERC-20 tokens are well established, many teams find them easier to deploy and integrate. During this stage, Ethereum Token Development Services are often used to refine token logic, improve gas efficiency, and reduce security risks.

NFTs are better suited for platforms where individual ownership and uniqueness are central to the user experience.

They are often used in:

Creator and art platforms

Games with tradable digital assets

Access-based communities and memberships

Real-world asset representation

NFT development introduces additional considerations such as metadata storage, royalty logic, and marketplace compatibility. This is where practical experience in Ethereum Token Development becomes especially important.

Both token types involve smart contract development, but the level of complexity differs.

Fungible token development typically involves:

Simpler contract logic

Lower auditing and maintenance overhead

Faster deployment timelines

Predictable transaction behavior

NFT development usually involves:

More complex contract structures

Decisions around on-chain vs off-chain metadata

Higher gas costs for minting and transfers

Additional UX considerations for users

An experienced Ethereum Token Development Company can help teams evaluate these factors early, avoiding unnecessary features and long-term inefficiencies.

Many modern Web3 platforms don't limit themselves to a single token type.

Common hybrid approaches include:

Games using fungible tokens for currency and NFTs for assets

Membership platforms combining access NFTs with reward tokens

Metaverse ecosystems using NFTs for land and tokens for governance

While flexible, these models require careful planning to ensure smart contracts interact securely and predictably.

Token design also intersects with broader concerns such as:

Smart contract security and audits

Regulatory interpretation of token utility

Upgradeability and future changes

Scalability and Layer-2 compatibility

These considerations often lead teams to seek guidance from an Ethereum Token Development Company, particularly when moving from experimentation to production.

A few practical questions can guide your decision:

Do users need interchangeable value or unique ownership?

Will transactions happen frequently or occasionally?

Is liquidity more important than scarcity?

Does your product rely on access, identity, or proof?

Clear answers usually point toward fungible tokens, NFTs, or a combination of both.

Fungible tokens and NFTs are tools designed for different outcomes. Neither is inherently better.

Strong Ethereum projects succeed by matching token design to real user needs, not market hype. Whether you're in early research or preparing to launch, understanding these fundamentals leads to more resilient products.

If you're assessing standards, security, or scalability, working with an experienced Ethereum Token Development Company can help clarify decisions without adding unnecessary complexity.

What is the main difference between fungible tokens and NFTs?

Fungible tokens are interchangeable and equal in value, while NFTs are unique and represent individual ownership.

Are NFTs suitable for payments?

NFTs can be transferred, but they are inefficient for payments. Fungible tokens are better for transactional use cases.

Which token type scales better on Ethereum?

Fungible tokens generally scale better due to simpler contract logic and lower gas costs.

Can a project use both fungible tokens and NFTs?

Yes. Many platforms use both to support different functions within the same ecosystem.

When should I involve an Ethereum Token Development Company?

When planning token standards, security audits, scalability, or compliance beyond basic experimentation.

Blockchain adoption is no longer limited to early adopters or niche technology firms. Today, startups, enterprises, and digital-first businesses are actively exploring blockchain-based platforms to improve transparency, automation, and user trust. As the New Year begins, CryptoApe has introduced a limited-period initiative that reduces the cost barrier to blockchain development by offering up to 5...

Read More

Blockchain adoption is no longer limited to early adopters or niche technology firms. Today, startups, enterprises, and digital-first businesses are actively exploring blockchain-based platforms to improve transparency, automation, and user trust. As the New Year begins, CryptoApe has introduced a limited-period initiative that reduces the cost barrier to blockchain development by offering up to 5...

Read More

Blockchain adoption is no longer limited to early adopters or niche technology firms. Today, startups, enterprises, and digital-first businesses are actively exploring blockchain-based platforms to improve transparency, automation, and user trust. As the New Year begins, CryptoApe has introduced a limited-period initiative that reduces the cost barrier to blockchain development by offering up to 50% off across its blockchain product ecosystem.

Rather than positioning this as a sales-driven campaign, it's better understood as an opportunity for businesses to evaluate, build, or scale blockchain solutions at a lower financial risk. This article explores what the New Year Blast includes, who it may be relevant for, and how organizations can approach blockchain development more strategically in the coming year.

The New Year Blast is structured around accessibility. Blockchain development often involves significant upfront investment-particularly for platforms such as crypto exchanges, DeFi applications, or NFT marketplaces. By reducing development costs, CryptoApe aims to make experimentation and deployment more practical for a wider range of businesses.

From a technology standpoint, the offer applies to both pre-built blockchain frameworks and custom development services, allowing flexibility based on business size, industry, and technical requirements.

Blockchain technology has steadily moved from experimentation to implementation. Several factors are contributing to this shift:

Increased demand for decentralized financial systems

Growing focus on data ownership and transparency

Expansion of Web3 applications beyond cryptocurrency

Maturing regulatory clarity in multiple regions

As organizations look to modernize digital infrastructure, blockchain-based systems are being evaluated for long-term scalability rather than short-term trends.

Crypto exchange platforms remain one of the most widely adopted blockchain use cases. These platforms facilitate digital asset trading while integrating security protocols, liquidity mechanisms, and compliance tools.

From an informational perspective, modern crypto exchange software typically includes:

Order matching engines

Secure wallet infrastructure

Risk management controls

User authentication and compliance layers

Lower development costs can make it easier for businesses to test exchange models without committing to large capital expenditures.

Decentralized finance applications operate through smart contracts rather than centralized intermediaries. DeFi platforms support use cases such as decentralized trading, lending, staking, and yield mechanisms.

For businesses researching DeFi adoption, key considerations often include:

Smart contract reliability

On-chain transparency

User interface simplicity

Network scalability

The New Year cost reduction allows teams to prototype and deploy DeFi products with measured financial exposure.

NFT marketplaces support digital ownership verification across sectors such as gaming, media, ticketing, and digital collectibles. Beyond art-focused platforms, NFTs are increasingly being explored for utility-driven applications.

Typical NFT marketplace features include:

Token minting functionality

Creator royalty mechanisms

Wallet integrations

Multi-chain compatibility

For organizations evaluating NFT-based models, reduced development costs can support market testing before large-scale rollout.

Web3 applications focus on decentralization, peer-to-peer interaction, and user-controlled data. These applications often integrate blockchain, smart contracts, and decentralized storage systems.

Common Web3 use cases include:

DAO governance platforms

Decentralized identity systems

Blockchain-based gaming environments

Token-powered communities

From a strategic viewpoint, Web3 development aligns with long-term shifts toward user-centric digital ecosystems.

Smart contracts form the operational backbone of blockchain platforms. Errors or vulnerabilities in these contracts can lead to significant risks, making development and auditing equally important.

Smart contract services typically involve:

Business logic translation into code

Security-focused development practices

Automated testing

Independent auditing processes

Lower entry costs can help teams prioritize security without compromising budgets.

Startups exploring blockchain ideas can use the New Year initiative to validate concepts before seeking additional funding.

Mid-sized firms planning to integrate blockchain features into existing platforms may find the reduced development cost beneficial.

Larger organizations assessing blockchain for operational efficiency or transparency can approach pilot projects with lower financial exposure.

Before moving forward with any blockchain project, businesses should consider:

Clear problem definition and use case relevance

Target users and adoption strategy

Regulatory and compliance requirements

Long-term maintenance and scalability

Cost savings are most effective when paired with thoughtful planning and realistic implementation goals.

Launching or upgrading blockchain platforms early in the year allows organizations to:

Align technical development with annual business goals

Allocate resources more effectively

Conduct phased testing and improvements

Respond faster to market feedback

From a planning perspective, timing can be as important as technology choice.

The CryptoApe New Year Blast provides a practical opportunity for businesses to approach blockchain development with reduced financial risk. By lowering cost barriers across multiple blockchain products, it enables experimentation, planning, and implementation in a more controlled and strategic manner.

For organizations considering crypto platforms, DeFi systems, NFT marketplaces, or Web3 applications, the New Year presents a natural checkpoint to evaluate technology direction. When approached thoughtfully, blockchain development can support long-term digital growth rather than short-term experimentation.

Curious to see how a blockchain solution would actually work for your business use case?

Request a free demo to explore the platform's core features, user flow, and technical capabilities in a practical, no-obligation walkthrough. This helps you evaluate functionality, scalability, and real-world applicability before making any development decisions.

The initiative covers a broad range of blockchain solutions, including crypto exchange platforms, DeFi applications, NFT marketplaces, Web3 applications, and smart contract development services.

Yes. The reduced development cost can help beginners explore blockchain use cases without committing to large upfront investments.

In most cases, both customizable frameworks and fully tailored blockchain solutions are included, depending on project scope and requirements.

Cost reductions are related to seasonal pricing, not reduced technical standards. Quality, security, and scalability considerations remain essential.

Starting early in the year allows for better planning, phased deployment, and alignment with long-term business objectives.

Read Full Blog... Decentralized finance has evolved significantly since the early days of crypto swaps and liquidity pools. In 2026, decentralized exchanges (DEXs) are no longer experimental products-they are essential infrastructure within the Web3 ecosystem. As more businesses explore DeFi opportunities, one concept continues to surface: the Uniswap Clone Script. Rather than building a decentralized exchange enti...

Read More

Decentralized finance has evolved significantly since the early days of crypto swaps and liquidity pools. In 2026, decentralized exchanges (DEXs) are no longer experimental products-they are essential infrastructure within the Web3 ecosystem. As more businesses explore DeFi opportunities, one concept continues to surface: the Uniswap Clone Script. Rather than building a decentralized exchange enti...

Read More

Decentralized finance has evolved significantly since the early days of crypto swaps and liquidity pools. In 2026, decentralized exchanges (DEXs) are no longer experimental products-they are essential infrastructure within the Web3 ecosystem. As more businesses explore DeFi opportunities, one concept continues to surface: the Uniswap Clone Script.

Rather than building a decentralized exchange entirely from scratch, many teams are choosing structured, open-source-based frameworks that reduce complexity while maintaining flexibility. This article explains what a Uniswap Clone Script is, how it functions, and why it continues to be relevant in 2026-without hype or sales language.

A Uniswap Clone Script is a pre-built decentralized exchange framework inspired by Uniswap's automated market maker (AMM) model. It includes the core smart contract logic required for token swaps, liquidity pools, and decentralized trading-while allowing developers to modify features based on specific use cases.

Importantly, it does not mean copying Uniswap line by line. Instead, it refers to using a similar architectural approach built on open-source principles, which developers can extend or adapt for new blockchain networks, governance models, or liquidity strategies.

In practice, this approach helps teams avoid rebuilding foundational DeFi mechanics that are already well understood and battle-tested.

To understand its usefulness, it helps to look at how this system functions technically.

Automated Market Maker (AMM):

Trades are executed using mathematical formulas rather than order books.

Liquidity Pools:

Users provide token pairs to pools, enabling swaps and earning transaction fees.

Smart Contracts:

All logic-pricing, swaps, and rewards-is handled by self-executing blockchain code.

Wallet-Based Interaction:

Users connect non-custodial wallets, retaining control over their assets.

This architecture reduces reliance on intermediaries and increases transparency, which remains a central goal of decentralized finance.

By 2026, decentralized exchanges are part of mainstream crypto activity. AMM-based models like Uniswap's have demonstrated long-term viability, handling high trading volumes across multiple market cycles. Using a Uniswap Clone Script allows builders to rely on proven mechanics rather than untested ideas.

Building a DEX from the ground up requires deep expertise in smart contracts, security audits, front-end integration, and ongoing maintenance. A Uniswap Clone Script reduces redundant engineering work while still allowing teams to implement custom logic, governance rules, or token economics.

Today's Uniswap Clone Software often supports:

EVM-compatible blockchains

Layer 2 scaling solutions

Reduced gas-fee environments

Modular smart contract upgrades

This adaptability matters as blockchain ecosystems continue to fragment and specialize.

Many vulnerabilities in DeFi arise from experimental designs. Clone-based frameworks rely on patterns that have been audited, tested, and improved over time. While audits are still essential, starting from known structures lowers baseline risk.

Uniswap Clone Scripts are now used in more focused and purpose-driven environments rather than generic exchanges.

Common examples include:

Token swap platforms for specific ecosystems

Liquidity hubs for gaming or NFT economies

Private or semi-permissioned DeFi platforms

DAO-governed trading protocols

Cross-chain liquidity applications

These use cases show how the model continues to evolve beyond simple token swaps.

From a practical standpoint, a Uniswap Clone Script helps teams address several real-world challenges:

Shorter development timelines

Lower initial engineering costs

Easier protocol upgrades

Faster testing and iteration

Improved focus on user experience and liquidity design

This allows teams to concentrate on differentiation rather than foundational mechanics.

While useful, clone-based development is not a shortcut to success.

Considerations include:

Smart contracts still require independent audits

Liquidity strategy is critical and non-trivial

UI/UX design strongly impacts adoption

Governance models must be thoughtfully designed

Understanding these limitations helps set realistic expectations.

In 2026, the value of a Uniswap Clone Script lies in its practicality. It offers a stable, flexible foundation for decentralized exchange development without forcing teams to reinvent proven DeFi mechanisms.

For builders focused on long-term sustainability, security, and adaptability, clone-based frameworks remain a logical starting point-not because they are easy, but because they are efficient and well-understood.

Understanding how and why they work is the first step toward making informed decisions in the evolving DeFi landscape.

A Uniswap Clone Script is a customizable decentralized exchange framework based on Uniswap's AMM architecture, used to build DEX platforms efficiently.

Yes. Its underlying AMM model remains widely used and adaptable to modern blockchain networks and scaling solutions.

It provides a pre-tested foundation, reducing development time and technical risk while allowing customization.

Most modern implementations are designed for multi-chain compatibility and Layer 2 integration.

No. Innovation typically happens in governance, liquidity models, integrations, and user experience rather than core swap mechanics.

Read Full Blog... The cryptocurrency exchange landscape is packed with ambition, but not every platform survives long enough to gain user trust. New exchanges launch regularly, yet many exit early due to development complexity, liquidity issues, compliance pressure, and security incidents. The pattern repeats often enough that founders naturally ask: Is there a more sustainable way to launch without repeating the s...

Read More

The cryptocurrency exchange landscape is packed with ambition, but not every platform survives long enough to gain user trust. New exchanges launch regularly, yet many exit early due to development complexity, liquidity issues, compliance pressure, and security incidents. The pattern repeats often enough that founders naturally ask: Is there a more sustainable way to launch without repeating the s...

Read More

The cryptocurrency exchange landscape is packed with ambition, but not every platform survives long enough to gain user trust. New exchanges launch regularly, yet many exit early due to development complexity, liquidity issues, compliance pressure, and security incidents. The pattern repeats often enough that founders naturally ask:

Is there a more sustainable way to launch without repeating the same failures?

One approach gaining credibility is beginning with a Coinbase Clone Script - not to shortcut innovation, but to remove the heavy technical lift of building every feature from zero. When the foundation is stable, teams can invest their efforts where survival actually depends: liquidity, compliance, scalability, and long-term trust.

After observing trends across exchange launches, failures generally stem from a few recurring problems:

Building a full trading platform - matching engines, wallet systems, UI/UX layers, blockchain integration - can stretch into a year or more. By the time a product is ready, market momentum or funding may already be gone.

Even small vulnerabilities can cause asset theft, personal data exposure, or API exploitation. A lack of hardened wallet management is often the first point of failure.

Traders avoid empty markets. No orders means no activity, and no activity means users leave. Many early platforms launch before solving liquidity flow.

A crypto exchange is more than code - it's a financial environment. Licensing, AML/KYC, audit-ready logs, and cross-border regulations take time, and many startups stall here.

Teams that spend everything on engineering rarely have enough left for liquidity partnerships, security audits, user education, and long-term development.

A Coinbase Clone Script cannot guarantee success, but it can remove several early risk points. Instead of building complex fundamentals from scratch, founders start from an already structured base. This allows the product to move faster and more confidently through early growth stages.

Where it makes a practical difference:

It shortens development time significantly

Core structure is already audited and tested

Liquidity integrations are typically simpler

Compliance frameworks like KYC/AML are pre-aligned

Teams can allocate budget to scaling instead of re-engineering

The goal isn't to copy; it's to build on top of something proven.

Most Coinbase Clone Software setups offer a foundational architecture designed for extension, branding, liquidity scaling, compliance work, and regional expansion. It is not limited to UI design - it spans wallet logic, trading engine mechanics, and administrative monitoring tools.

Multi-signature wallet controls

Cold + hot storage split for risk minimization

Identity and transaction monitoring

Layered authentication systems

Real-time matching algorithms

Limit and market order execution

Market depth visibility and charting tools

Fee configuration for platform economics

Simple onboarding flow for beginners

Mobile adaptability and Coinbase Clone App compatibility

Notification-based account alerts

Support for fiat gateways or payment rails

KYC/AML verification layers

Dispute resolution modules

Audit-friendly transaction logs

Policy-driven access controls

These components form a foundation - innovation happens above this layer.

Why do new exchanges shut down early?

Most fail due to security weaknesses, liquidity limitations, long development cycles, regulatory friction, and resource exhaustion.

How does a Coinbase Clone Script help?

It supplies exchange fundamentals - trading engine, wallet system, security logic - reducing development time and operational risk.

Is a Coinbase Clone App usable for mobile trading?

Yes. Many frameworks support mobile-responsive interfaces and app-level expansion for Android/iOS.

Does this limit future innovation?

No. It simply removes baseline engineering so teams can focus on growth, compliance, and trust building.

Crypto exchange failure usually stems from operational weight, not conceptual weakness.

A Coinbase Clone Script offers a stable starting point for development, audit-readiness, and user onboarding.

Teams gain time to work on liquidity, compliance, security reviews, and long-term scaling.

Launching strong is less about rushing - more about reducing risk early.

Many exchanges don't fail because their idea lacks potential, but because the execution window is short, expensive, and unforgiving. A Coinbase Clone Software provides a structural base so founders can focus on resilience rather than survival. The pressure shifts from building foundational code to building durable trust.

Read Full Blog... Modern dApps rarely work without tokens, especially in ecosystems powered by ERC-20 or similar standards. Whether you're building a simple utility token or managing a complete on-chain workflow, understanding how to connect your token to a frontend is essential. Even if you're collaborating with an Ethereum Token Development Company, knowing the integration steps helps you troubleshoot iss...

Read More

Modern dApps rarely work without tokens, especially in ecosystems powered by ERC-20 or similar standards. Whether you're building a simple utility token or managing a complete on-chain workflow, understanding how to connect your token to a frontend is essential. Even if you're collaborating with an Ethereum Token Development Company, knowing the integration steps helps you troubleshoot iss...

Read More

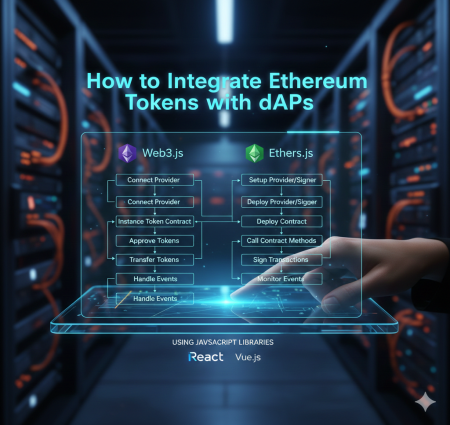

Modern dApps rarely work without tokens, especially in ecosystems powered by ERC-20 or similar standards. Whether you're building a simple utility token or managing a complete on-chain workflow, understanding how to connect your token to a frontend is essential. Even if you're collaborating with an Ethereum Token Development Company, knowing the integration steps helps you troubleshoot issues, build better user flows, and understand what happens behind the scenes.

This guide walks through the practical steps of integrating Ethereum tokens using Web3.js and Ethers.js, the two most widely used JavaScript libraries in the Ethereum ecosystem. The focus is on clarity, accuracy, and real-world development patterns rather than hype.

A token only becomes useful when your application can:

Read balances

Trigger transfers

Interact with allowances

Respond to events

Communicate with user wallets

If any part of this chain breaks, users experience lag, failed transactions, or missing data - the quickest way to lose trust. That's why many teams rely on structured workflows often recommended by an experienced Ethereum Token Development Company or smart contract specialist.

A long-standing library that developers have used for years. It's stable and widely supported, especially across older tutorials and frameworks.

A leaner, more modern alternative with clearer syntax. Many developers prefer it for production-grade builds due to better security patterns and improved handling of BigNumbers.

Both libraries can:

Connect to wallets

Read contract state

Send transactions

Interact with ERC-20 functions

Work across networks (mainnet, testnets, L2s)

Below is a simple but realistic integration workflow you can adapt to any dApp.

npm install web3

const web3 = new Web3(window.ethereum);

await window.ethereum.request({ method: "eth_requestAccounts" });

You'll need the contract ABI and its deployed address - normally available from your developer or the smart contract repository.

const token = new web3.eth.Contract(abi, tokenAddress);

const accounts = await web3.eth.getAccounts();

const balance = await token.methods.balanceOf(accounts[0]).call();

await token.methods.transfer(receiver, amount).send({ from: accounts[0] });

This is the foundation of most ERC-20 interactions, regardless of whether your token came from ethereum token development services or a custom project.

Many developers prefer Ethers.js due to its simplicity and reliability.

npm install ethers

const provider = new ethers.providers.Web3Provider(window.ethereum);

await provider.send("eth_requestAccounts", []);

const signer = provider.getSigner();

const token = new ethers.Contract(tokenAddress, abi, signer);

const balance = await token.balanceOf(await signer.getAddress());

await token.transfer(receiver, amount);

Ethers.js also simplifies working with units and handling gas estimation - helpful when working with any ethereum token development solutions or custom smart contracts.

Here are insights commonly shared in technical documentation, audits, and code reviews:

Missing or modified functions often cause unexpected integration issues.

Even trivial checks (empty fields, malformed addresses) prevent broken transactions.

Guide users when they are on the wrong chain.

Listening to Transfer events keeps balance displays accurate.

Tools like Hardhat or Foundry help you catch issues early.

These practical habits apply to any ERC-20, erc 20 token, eth erc20 workflow, regardless of whether you're building alone or with a token development company.

Using an incorrect or outdated ABI

Forgetting to convert values using parseUnits

Not handling asynchronous wallet switching

Assuming the user is already connected

Hardcoding RPC URLs without fallbacks

Fixing these early helps prevent confusing UX issues.

Integrating Ethereum tokens into a dApp becomes much easier once you understand how Web3.js and Ethers.js connect your frontend with the blockchain. Everything revolves around a few key steps: connecting a wallet, loading the contract, reading values, and sending transactions. With clean code structure and thoughtful UX, even complex token flows can feel seamless.

If you're planning further development, reviewing your architecture with an experienced team or an Ethereum Token Development Company can help ensure your token logic, contract design, and integration patterns stay scalable.

Through a contract ABI loaded by Web3.js or Ethers.js, allowing the app to read data and send transactions.

Not necessarily. A frontend can communicate with wallets directly. A backend is optional for indexing, automation, or analytics.

Ethers.js is more modern and lightweight. Web3.js has wider legacy support. Both work for ERC-20 integration.

Yes. As long as you have the ABI and contract address, Ethers.js and Web3.js can interact with any Ethereum-based token.

The workflow is similar, but the functions differ since NFTs follow ERC-721 or ERC-1155 instead of ERC-20.

Read Full Blog... If you've ever explored how new crypto exchanges launch so quickly, you've probably noticed that many rely on some form of a Binance Clone Script. These frameworks, inspired by the design of the well-known Binance cryptocurrency exchange, promise a faster and more affordable way to build trading platforms. But a debate is growing: Are these clone-based solutions helping the industry progress, or a...

Read More

If you've ever explored how new crypto exchanges launch so quickly, you've probably noticed that many rely on some form of a Binance Clone Script. These frameworks, inspired by the design of the well-known Binance cryptocurrency exchange, promise a faster and more affordable way to build trading platforms. But a debate is growing: Are these clone-based solutions helping the industry progress, or a...

Read More

If you've ever explored how new crypto exchanges launch so quickly, you've probably noticed that many rely on some form of a Binance Clone Script. These frameworks, inspired by the design of the well-known Binance cryptocurrency exchange, promise a faster and more affordable way to build trading platforms.

But a debate is growing:

Are these clone-based solutions helping the industry progress, or are they just encouraging more repetitive ideas?

This question matters because crypto exchanges influence liquidity, accessibility, and how people interact with digital assets worldwide. Let's unpack this conversation with clarity and fairness-minus hype.

A Binance Clone Script is a ready-to-deploy software solution that mirrors the architecture and features of the Binance exchange. It typically includes trading modules, order matching systems, wallet functions, and user interfaces similar to what you'd find on established crypto exchanges.

In short: It's a shortcut for building an exchange without reinventing the wheel.

These solutions didn't rise in popularity by accident. They solved real problems for entrepreneurs trying to enter a complex market.

Building an exchange from scratch takes months. Clone-based projects reduce this timeframe significantly, helping teams focus on strategy instead of building every component manually.

Because the blueprint resembles binance exchange systems, developers know what to expect. This makes it easier to avoid early engineering mistakes.

The financial barrier drops sharply, opening the door for smaller teams or regional platforms to experiment with exchange development.

People who've used the Binance cryptocurrency exchange feel comfortable navigating similar layouts. That familiarity reduces friction for new platforms trying to earn user trust.

Despite criticism, clone-based platforms have actually supported innovation in several areas:

In many countries, building a full-scale exchange from the ground up isn't feasible. Clone frameworks allow teams to create local fiat support, regional languages, and compliance structures that global exchanges overlook.

Teams can modify the base structure to test:

new trading pairs

mobile-first interfaces

multi-chain swaps

educational features

beginner-focused setups

This allows experimentation that might not happen otherwise.

More exchanges can increase competition, which often leads to better:

liquidity options

user experience

customer support

regulatory clarity

There's value in diversity, even if some platforms start from the same foundation.

At the same time, relying too heavily on Binance Clone Software has drawbacks-especially when projects don't push beyond the template.

A major concern is sameness. When dozens of platforms look identical, it reduces user curiosity and makes the ecosystem feel repetitive. Innovation slows down when teams simply replicate existing models.

Not all clones are created equally. Some are built without proper testing or security hardening. Risks include:

weak wallet configurations

inadequate encryption

unverified third-party libraries

unreliable trading engines

When low-quality exchanges fail, they undermine trust across the broader crypto community.

If everyone follows the same structure, real breakthroughs become rarer. This limits the evolution of new models, whether in UI design, incentive structures, or decentralized features.

Clone-based exchanges may not fully adapt to local rules. When compliance isn't considered early, it can slow platform adoption or lead to shutdowns.

The clearest answer is this:

They help when used as a foundation. They hold the industry back when used as a finished product.

Innovation doesn't require building everything from scratch-but it does require intention. A strong base can support new ideas, but only if teams decide to build beyond standard features.

To get the best of both worlds-speed and originality-here's what founders and developers can focus on:

Instead of launching an exchange that mirrors the Binance exchange crypto experience, teams can explore:

community-based trading tools

AI-driven fraud detection

transparent fee structures

regional fiat ramps

Web3 integrations

These additions help platforms stand out.

A clone script should be the starting point, not the final defense. Teams can add:

stronger encryption

external audits

advanced authentication

cold wallet management

Security is one of the biggest trust factors in crypto exchanges.

Small, human-centered design updates often make a bigger difference than complex features. Listening to users is a simple but powerful competitive advantage.

Instead of creating "another exchange," define a purpose:

Serving beginners? Supporting institutional clients? Offering low-fee trading? Each focus leads to different features and better long-term value.

Binance Clone Script solutions aren't inherently good or bad. They're tools-useful when applied thoughtfully and limiting when used without direction. They've helped emerging teams launch exchanges quickly and with fewer technical risks. At the same time, the industry needs more creative approaches, not just more replicas.

The real opportunity lies in using these scripts as a base for innovation, not a substitute for it. When teams customize, refine, and build with purpose, clone frameworks can support meaningful progress in the world of cryptocurrency exchange development.

Yes. They're legal as long as branding, trademarks, and proprietary assets are not copied directly.

High-quality frameworks can scale, but performance depends on the underlying infrastructure and how well the system is optimized.

Security varies by provider. Strong encryption, audits, and reliable wallet management are essential for maintaining safety.

Not necessarily. Most frameworks allow full customization of the interface, features, and back-end logic.

Absolutely. Many teams build unique features on top of clone scripts, which can lead to fresh ideas and better user experiences.

Read Full Blog... Launching a mobile crypto exchange has become more accessible than it was a few years ago, but choosing the right development approach still requires careful thought. Among the available options, the Binance Clone Script often comes up as a straightforward way to build an exchange that offers the speed, usability, and structure traders expect. But does using a Binance Clone App genuinely make sens...

Read More

Launching a mobile crypto exchange has become more accessible than it was a few years ago, but choosing the right development approach still requires careful thought. Among the available options, the Binance Clone Script often comes up as a straightforward way to build an exchange that offers the speed, usability, and structure traders expect. But does using a Binance Clone App genuinely make sens...

Read More

Launching a mobile crypto exchange has become more accessible than it was a few years ago, but choosing the right development approach still requires careful thought. Among the available options, the Binance Clone Script often comes up as a straightforward way to build an exchange that offers the speed, usability, and structure traders expect.

But does using a Binance Clone App genuinely make sense? Is it flexible enough? Secure enough? Future-proof enough? And most importantly-does it align with what a modern crypto user needs?

Let's break this down in a clear, practical way, drawing from real development patterns and industry experience.

More than half of global crypto traders now access their accounts primarily through mobile apps. A mobile-first platform makes trading feel immediate, familiar, and convenient. Users appreciate:

Simple onboarding

Quick access to charts and orders

Real-time notifications

Intuitive navigation

Because of these expectations, many businesses look toward Binance Clone Software to create a similar mobile experience without building every layer from scratch.

A Binance Clone App is a pre-built mobile application designed to replicate the core flow and performance model of Binance. It includes a matching engine, wallet system, user dashboards, security modules, and APIs that are already structured for exchange use.

Think of it as a framework that accelerates development, not a shortcut that compromises quality. You still choose your branding, features, compliance methods, and UI adjustments-the clone simply provides the technical backbone.

The realistic answer: It depends on your goals and constraints.

For many startups, it's one of the most practical and balanced approaches. For others, especially those aiming for highly specialized trading functions, a clone may feel limiting.

Here's a breakdown to help you evaluate it objectively.

Building a full exchange from the ground up can stretch across several months due to architecture planning, testing, audits, and security hardening.

A clone-based structure typically reduces that timeline significantly because many base components are already tested and functional.

This makes it suitable for teams trying to enter the market while a specific opportunity or trend is still active.

Users adapt more quickly to platforms that resemble what they already use. A clone app reflects familiar navigation and flow, which helps reduce early user friction.

This is especially helpful for first-time traders who may otherwise struggle with learning an entirely new interface.

Mobile exchanges rely on multiple layers-matching engines, wallet integrations, API handling, security protocols.

A pre-built script reduces the chances of early-stage bugs or structural vulnerabilities because the foundation is already in place.

It doesn't eliminate the need for audits, but it does make the process more predictable.

Custom development carries a significant cost due to engineering complexity, infrastructure setup, and continuous iteration.

A Binance Clone App Development model reallocates spending from expensive base-layer coding to:

UI customization

Compliance

Security upgrades

Market expansion

This makes financial planning more manageable in the beginning stages.

If your vision involves a highly unconventional layout, experimental features, or a distinctive user journey, a clone may feel restrictive. Full custom development might be the better route.

Things like high-frequency derivatives, institution-focused tools, or unique liquidity models might require architecture that goes beyond a clone's standard layout.

Some teams want 100% ownership over their backend logic for research-driven or long-term scaling reasons. In such cases, a clone may only serve as a temporary prototype.

A strong clone solution generally includes:

Spot order types

Price charts

Order history

Market pairs

Portfolio summaries

These form the user-facing core of most exchanges.

Multi-factor authentication

Encryption for data handling

Hot and cold wallet division

Anti-DDoS and firewall layers

Secure API authentication

Security remains non-negotiable, especially in mobile-first environments.

KYC verification flows

Fee configuration

Notification systems

Audit logs

Support ticket tools

These features help the exchange operate smoothly behind the scenes.

Many challenging parts of exchange development-like wallet infrastructure and engine logic-are pre-built.

The UI/UX resemblance shortens the learning curve.

Most clone scripts use modular architecture, which allows teams to add features as they grow.

Instead of overinvesting upfront, teams can build steadily and validate user demand along the way.

Using a clone script is legal as long as the platform:

Uses original branding

Avoids mimicking trademarks

Follows local crypto regulations

Security still requires independent verification through audits, code reviews, and penetration testing. Clone scripts provide structure, but responsibility for safe deployment still rests with the exchange operator.

For most teams that value:

Faster launch timelines

Lower development barriers

Predictable structure

Customizable modules

…a Binance Clone Script is a practical and effective starting point. It helps teams focus on user experience, compliance, and market strategy rather than rebuilding foundational components.

However, teams needing highly specialized systems or aiming for long-term, enterprise-grade architecture may prefer custom development.

The "best" choice depends on the balance between speed, customization, budget, and long-term vision.

A Binance Clone App offers a solid foundation for building a mobile exchange, particularly for teams seeking predictable development, reduced technical complexity, and faster deployment. It's not the only method available, but it strikes a strong balance between practicality and scalability for most early-stage and mid-stage projects.

Understanding your goals, technical capabilities, and regulatory responsibilities will help you decide whether a clone-based approach aligns with your roadmap.

If you're exploring different ways to build a mobile crypto exchange and want a structured, proven starting point, consider reviewing your options with a clear focus on security, compliance, and feature requirements. Understanding these factors will guide you toward the right development model-clone-based or custom.

It's a pre-built mobile exchange application that mirrors Binance's core architecture, designed to speed up development without sacrificing essential features.

It can be secure when paired with audits, encryption, secure wallet management, and proper deployment practices.

Most teams launch in several weeks, depending on customization and compliance work.

Yes. UI, features, trading options, and workflows can be modified based on the project's goals.

It works well for early-stage and mid-stage platforms. Larger exchanges may eventually choose fully custom infrastructure.

Read Full Blog... Security Token Offerings (STOs) have become an increasingly popular way to raise capital in the blockchain space. Unlike traditional ICOs, STOs are regulated, giving investors legal protection and offering a level of transparency that builds trust. But launching a security token isn't just about coding-it's about understanding and meeting the legal requirements that keep your project compliant and...

Read More

Security Token Offerings (STOs) have become an increasingly popular way to raise capital in the blockchain space. Unlike traditional ICOs, STOs are regulated, giving investors legal protection and offering a level of transparency that builds trust. But launching a security token isn't just about coding-it's about understanding and meeting the legal requirements that keep your project compliant and...

Read More

Security Token Offerings (STOs) have become an increasingly popular way to raise capital in the blockchain space. Unlike traditional ICOs, STOs are regulated, giving investors legal protection and offering a level of transparency that builds trust. But launching a security token isn't just about coding-it's about understanding and meeting the legal requirements that keep your project compliant and secure.

Whether you're an entrepreneur, developer, or investor exploring this space, knowing the legal framework is crucial. This guide explains what you need to consider from a legal standpoint and why working with experienced STO Development Services can make the process smoother.

STOs are considered securities in most jurisdictions. That means they're subject to rules designed to protect investors and maintain market integrity. Compliance isn't just a bureaucratic step-it's a foundation for credibility and long-term success.

Key reasons for legal compliance include:

Investor Protection: Regulatory compliance ensures investors know their rights and can trust the project.

Market Credibility: A legally compliant STO attracts more serious participants, including institutional investors.

Risk Management: Failure to comply can lead to fines, sanctions, or legal actions.

Global Opportunities: Being compliant allows your STO to reach international investors without running afoul of local laws.

By understanding these requirements, you reduce the risk of future complications and build a platform that both investors and regulators can trust.

Security tokens are classified as securities, so they must comply with the laws of the jurisdictions where they are offered. Important considerations include:

Registration: In many countries, tokens must be registered with financial regulators, like the SEC in the U.S. or SEBI in India.

Exemptions: Certain private offerings may be exempt from full registration but still require strict compliance with limits on the number and type of investors.

Disclosure Documents: Issuers usually need a detailed prospectus or whitepaper outlining the project, tokenomics, and potential risks.

Ensuring compliance with securities laws protects both the project and its investors.

Almost all jurisdictions require STOs to implement AML and KYC measures. These regulations prevent illicit funds from entering the system and ensure transparency for all investors.

Common steps include:

Collecting valid identification from all participants

Screening investors against global sanctions and watchlists

Keeping detailed, secure records of KYC procedures

Integrating AML/KYC into the platform is essential for both legal compliance and investor confidence.

The structure of your token plays a critical role in meeting legal requirements. Proper documentation includes:

Smart Contract Audits: Ensuring the token functions as intended and complies with legal standards.

Investment Agreements: Clearly outlining the rights and obligations of investors.

Whitepapers or Offering Memorandums: Providing a transparent overview of the project, token distribution, and regulatory compliance.

Good documentation can prevent legal disputes and reassure investors about the legitimacy of your offering.

Where you register and issue your STO matters. Jurisdictions differ in terms of:

Licensing requirements

Taxation rules

Crypto regulations

Choosing a regulatory-friendly jurisdiction can simplify compliance and provide additional legal protections for both the project and investors.

STO compliance is not a one-time task. Post-launch requirements often include:

Regular reporting to regulators

Maintaining investor records

Disclosing any significant changes affecting token value

An STO platform should include features for continuous monitoring, reporting, and communication to maintain compliance over time.

Grasping the legal framework for STOs isn't just about avoiding trouble. It provides practical advantages:

Enhanced Trust: Investors are more likely to participate in a legally compliant offering.

Clarity for Team Members: Everyone involved knows the legal boundaries and responsibilities.

Efficient Launch Process: Proper planning reduces delays and unexpected regulatory hurdles.

Scalability: Compliant platforms are easier to expand to new markets.

Even for technically skilled teams, integrating legal understanding with development is critical for a smooth and sustainable launch.

Define Your Token Model: Decide whether your token represents equity, debt, or a hybrid model.

Consult Legal Experts: Engage lawyers familiar with blockchain securities.

Choose Jurisdiction Carefully: Select a location with clear regulations and favorable rules for digital securities.

Implement AML/KYC Measures: Verify all participants' identities and prevent fraudulent activity.

Audit Smart Contracts: Ensure your code reflects legal obligations and operational standards.

Prepare Transparent Documentation: Draft whitepapers, investment agreements, and regulatory filings.

Launch Responsibly: Conduct the offering in full compliance with regulations and maintain ongoing reporting.

STO development is a complex mix of technical innovation and legal responsibility. By understanding securities laws, implementing AML/KYC procedures, creating thorough documentation, and considering jurisdictional regulations, you can launch a secure and compliant Security Token Offering.

A solid grasp of legal requirements not only protects your project but also enhances investor confidence, builds credibility, and lays the foundation for long-term success in the blockchain space.

Q1: Do I need a license to issue an STO?

A: Yes. In most regions, STOs are treated as securities and require registration or exemptions under applicable laws.

Q2: What is the role of AML and KYC?

A: They prevent illegal activity and verify investor identities, ensuring the offering remains compliant and trustworthy.

Q3: Can I offer an STO globally?

A: You can, but you must comply with the laws of each jurisdiction where investors are based.

Q4: Why is token documentation important?

A: Proper legal documentation clarifies investor rights, project obligations, and regulatory compliance.

Q5: What ongoing compliance is required?

A: Regular reporting, record-keeping, and disclosure of material events are usually required to maintain legality.

I want to Hire a Professional..